The UK gin market is diverse and experiencing disruption. New innovative gin brands (e.g. Clean Co, Amplify), as well as traditional brands (e.g. Gordon’s and Tanqueray) recently launched alcohol free gins.

EPIC Conjoint used it’s rapid Pricing and Product insights platform to conduct a Virtual Shelf Conjoint Analysis among a mix of 316 adults in the UK who drink alcohol gins regularly, drink alcohol-free gins regularly, who don’t drink alcohol-free gins but would consider doing so, which was conducted within 24 hours.

The purpose of our survey was to investigate if the Market Appetite and Willingness to Pay for alcohol vs. alcohol-free gins differed by customer segment (e.g. gender, age, favorite gin brands, frequency of alcohol consumption.

Since the launch of 0,0% gins does not only represent the introduction of a new product, rather a whole new product category - capturing robust Product and Pricing insights from target customers can be a game-changer for Gin manufacturers, wholesalers, distributors and retailers!

Survey Design

- EPIC Conjoint’s Virtual Shelf survey tested the following 10 most popular alcohol and non-alcohol gins in the UK currently: Gordon’s, Hendrick’s, Tanqueray, Beefeater, Bombay, Roku, Amplify, Clean Co.

- EPIC Conjoint’s unique Virtual Shelf Conjoint presents products in a competitive environment - on a fully-customizable digital supermarket shelf. This way, real-life trade-off decisions are mimicked more closely than ever before, unlocking game-changing product and pricing insights.

- True to EPIC Conjoint’s form, the conjoint survey was designed and in-field in the UK on 05.08.2022. 316 alcohol and alcohol -free gin respondents completed the survey within 4-5 hours. The conjoint results were available for analysis the next day.

General Insights

“UK consumers welcome alcohol-free Gin alternatives and are generally open to the idea”

- 83% of our 316 respondents agreed with the statement that alcohol-free gins are a great idea, since the taste of the gin is more relevant than whether it contains alcohol or not.

- Only 17% of the respondents stated that it’s not a great idea, since a gin without alcohol is not “a real gin”

- For frequent gin consumers (6+ times per month), alcohol gins outperformed the 0.0% variants.

“Alcohol-free gins are likely to be the UK consumers next product choice”

- An impressive 62% of respondents stated that it is (extremely) likely that they will buy a 0.0% gin, which is a strong result for such a product novelty that seemingly breaks with gin traditions. 22% of respondents are currently undecided, and only 16% consider a purchase of 0,0% gin as rather unlikely.

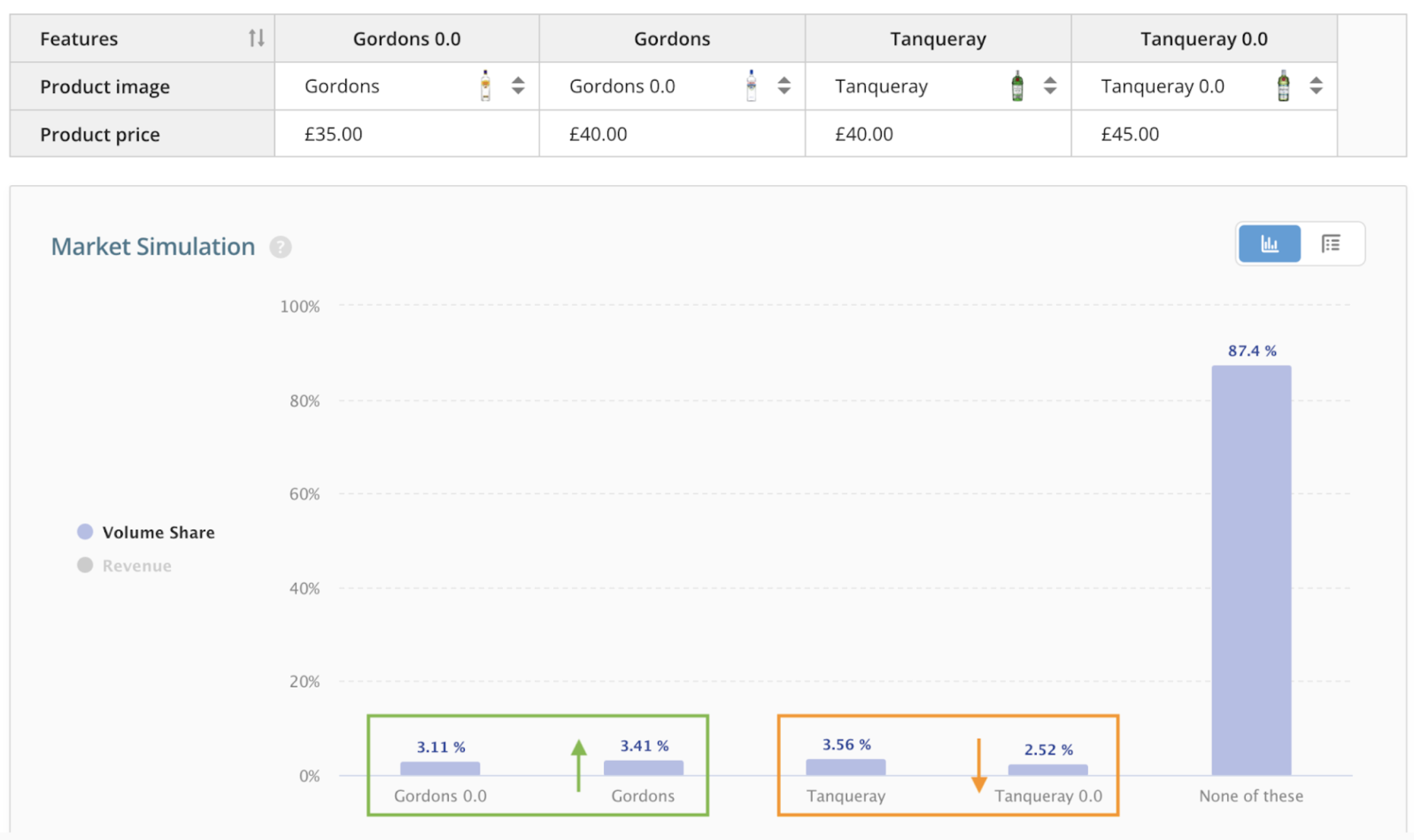

Insight Snippet #1: Additional Willingness to Pay for 0.0% gins exists and depend on the brand and the customer segment

Should beverage companies like Diageo (owns Gordon’s and Tanqueray gin brands) charge more or less for alcohol-free gins compared to the heritage product?

Our survey indicates some brands can charge a premium, while some can’t! Interestingly, regular alcohol-free gin consumers would accept paying a significant premium for Gordon’s alcohol-free version - while they are less willing to pay more for Tanqueray’s 0.0% gin.

With EPIC Conjoint’s market and price simulators, every competitive scenario can be analyzed for each individual customer segment - enabling game-changing insights to be unlocked!

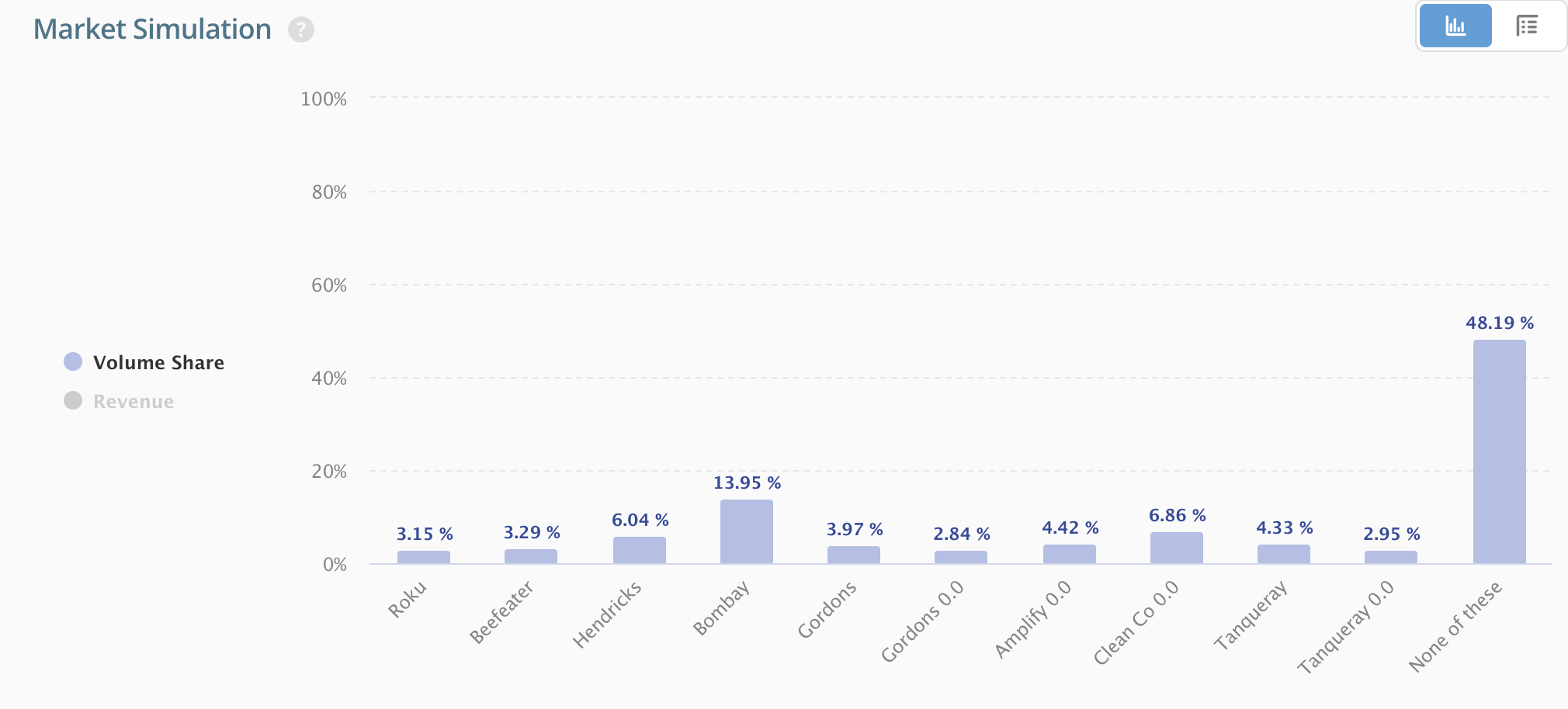

Insight Snippet #2: Market Share - The winner takes all! (Or not?)

Our analysis shows that the UK gin market is not a “winner takes it all!” market. On the contrary, alcohol-free gin versions have the potential to achieve significant market share.

For example, New and specialized brands such as Clean Co or Amplify can reach significant market share in the gin market, while heritage brands such as Gordon’s and Tanqueray face a slightly greater challenge.

Our experts would be delighted to guide you through various market simulations and/or to give you full-access to the result dashboard!

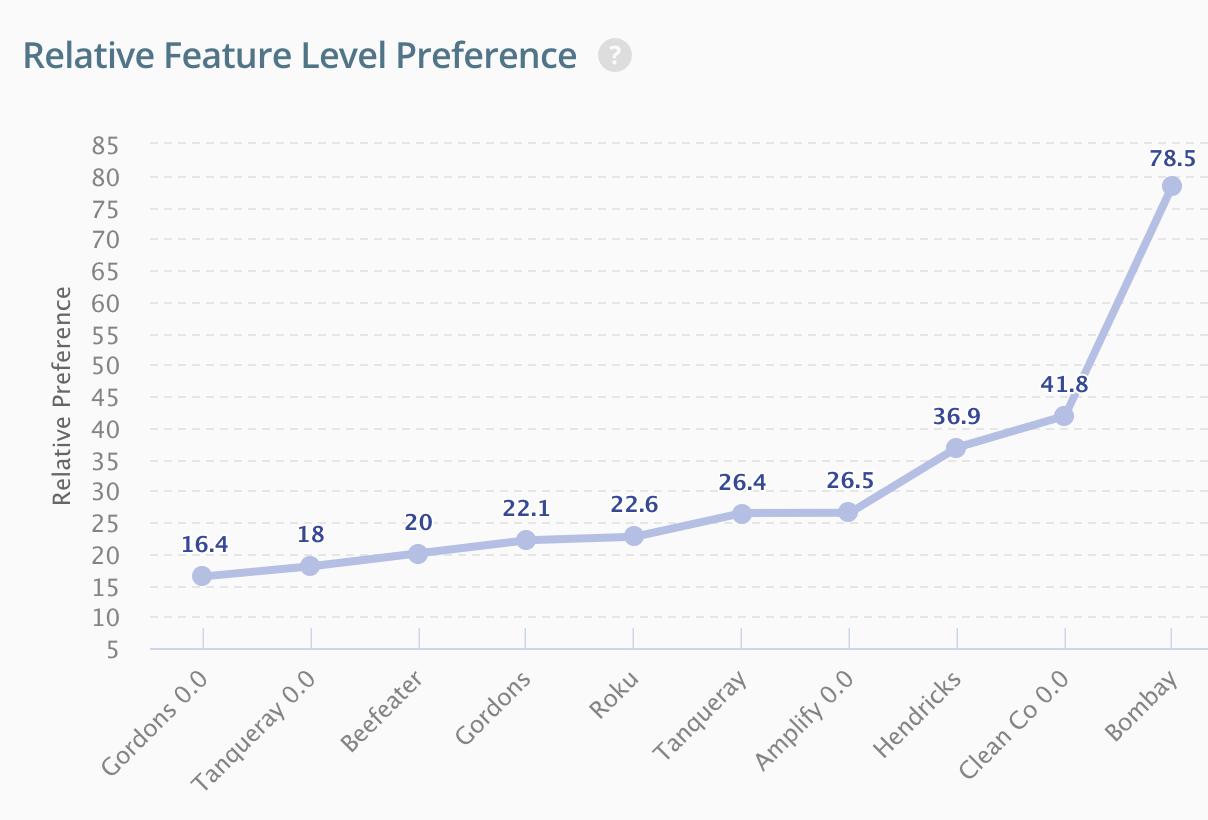

Insight Snippet #3: Consumer preferences are evolving and reward product innovation!

Across all respondents, Bombay was the most preferred gin in our survey, followed by Clean Co 0.0, Hendricks and Amplify 0.0 - which illustrates both the general interest in alcohol-free gins, as well as the many-faceted consumer preferences. For traditional brands, the alcohol versions are capture a significantly higher preference than the new 0,0% versions.

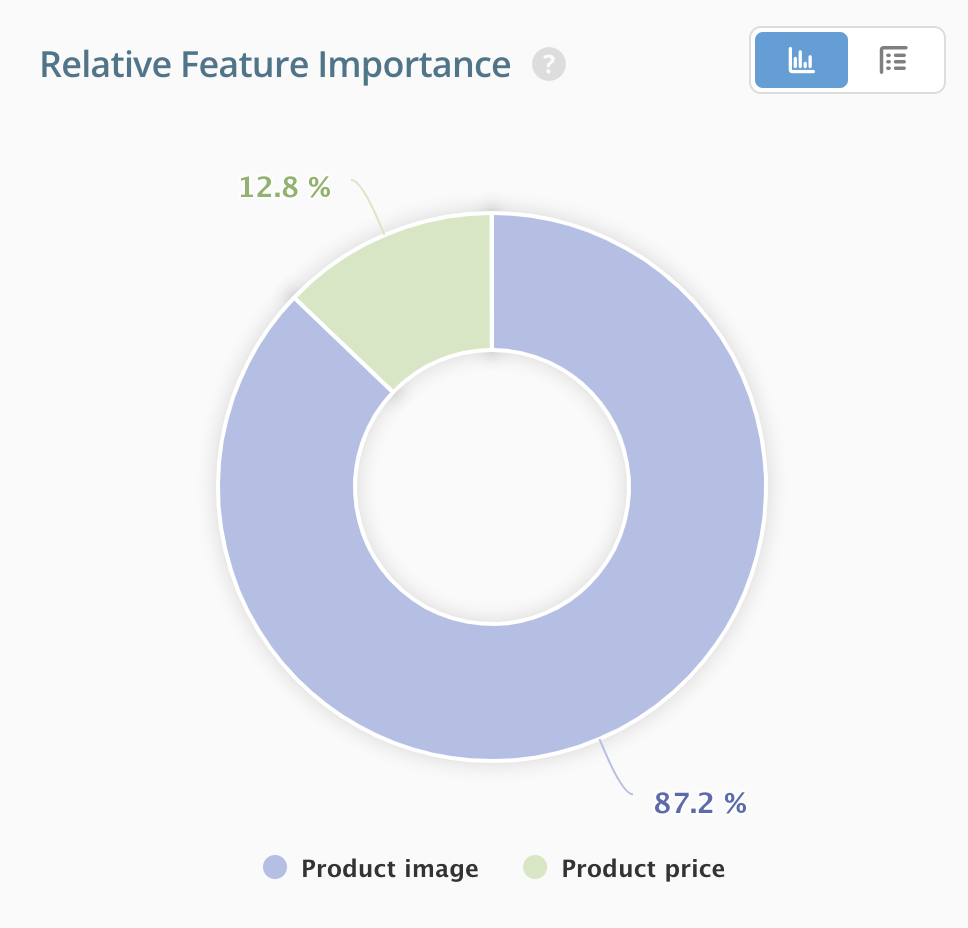

Insight Snippet #4: For gins, Consumers value Brands and Products over Price!

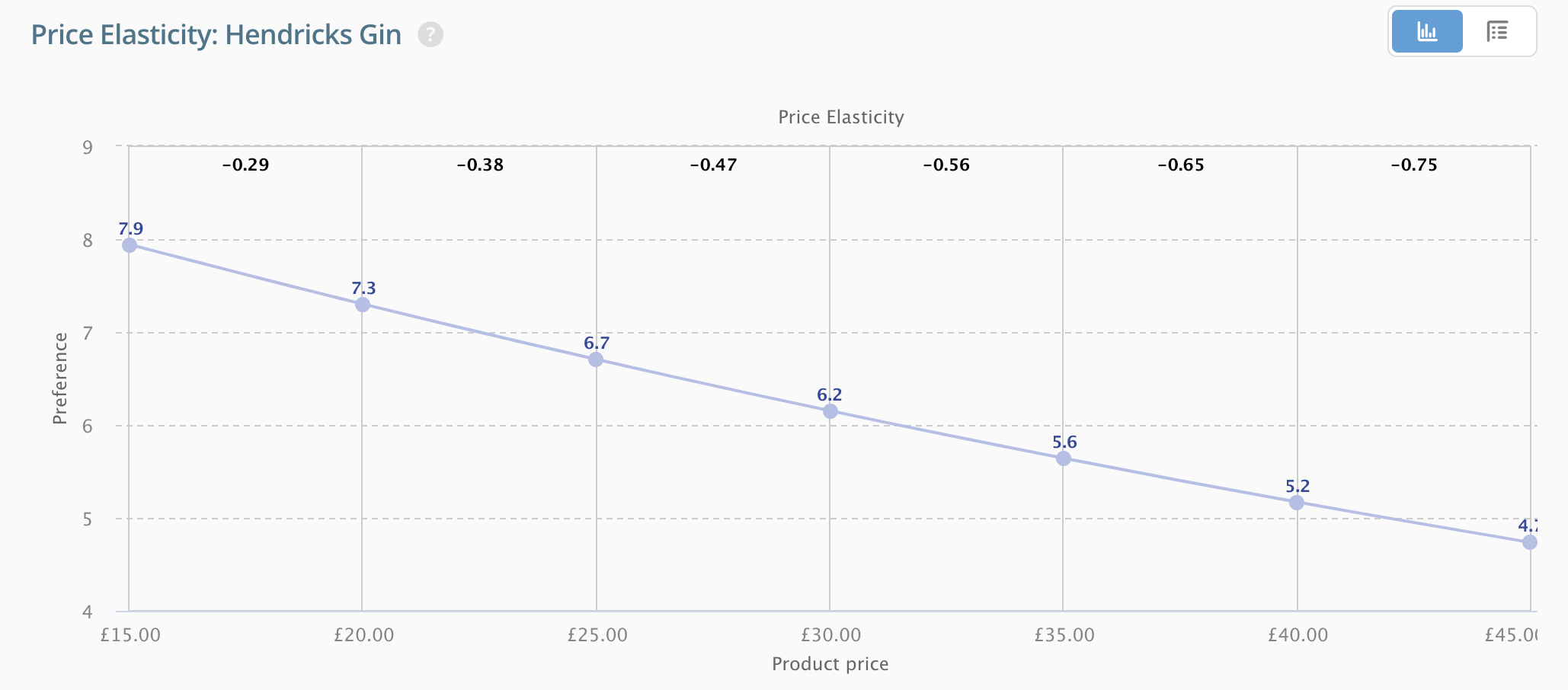

Knowing the price-value perception of your target group, as well as the Price Elasticity of various customer segments unlocks the potential for successful product and pricing decisions!

Our survey reveals that UK consumers value products and brands over price! 87% of consumers’ purchase decision is influenced by the product itself, with price being of minor importance (only 13%).

By accessing our gin survey, you can not only discover how strong the brand perception of your target group is, but also, how price sensitive consumers will react to price changes, by precisely measuring Price Elasticity of Demand for every single tested product! For example, the measured Price Elasticity for Hendrick’s gin varies between -0,29 to -0.75 depending on the price interval and competing products.

Our experts would be delighted to guide you through various market simulations and give you full-access to the results dashboard!

Access the Results dashboard to see for yourself

After submitting this request, an EPIC Conjoint expert will be in touch with you