Japan's economy is entering a new era marked by the onset of inflation, presenting both challenges and opportunities for Consumer Packaged Goods (CPG) and Over-the-Counter (OTC) brands. There is little opportunity left to offset inflation in input prices or labour costs due to the already highly efficient production that principles like Kaizen ensured. The result is that Japanese businesses will need to react to, or ideally, proactively take more price decisions to protect and grow their businesses. The impact of these increases is newsworthy with eternally popular brands like Black Thunder announcing their first increase in three decades (yes, 30 years!!!) with a sincere apology to their consumers.

Inflation squeeze

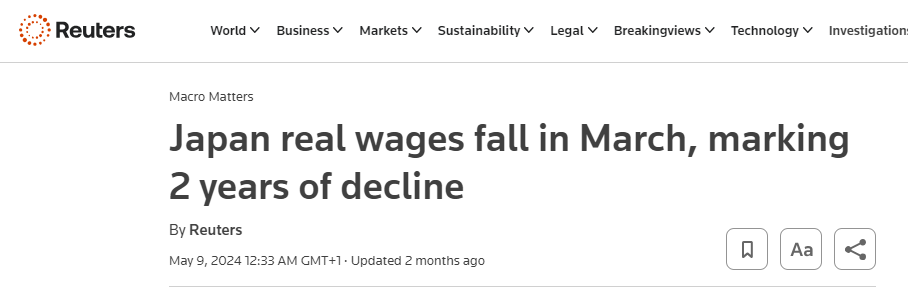

Momentum in price increases is continuing to grab headlines and as of May ‘24, CPI inflation is not being matched with wage inflation and so the general public are feeling the squeeze.

This paper explores the implications of inflation on Japan's CPG and OTC sectors, outlining strategic approaches to navigate this economic shift effectively.

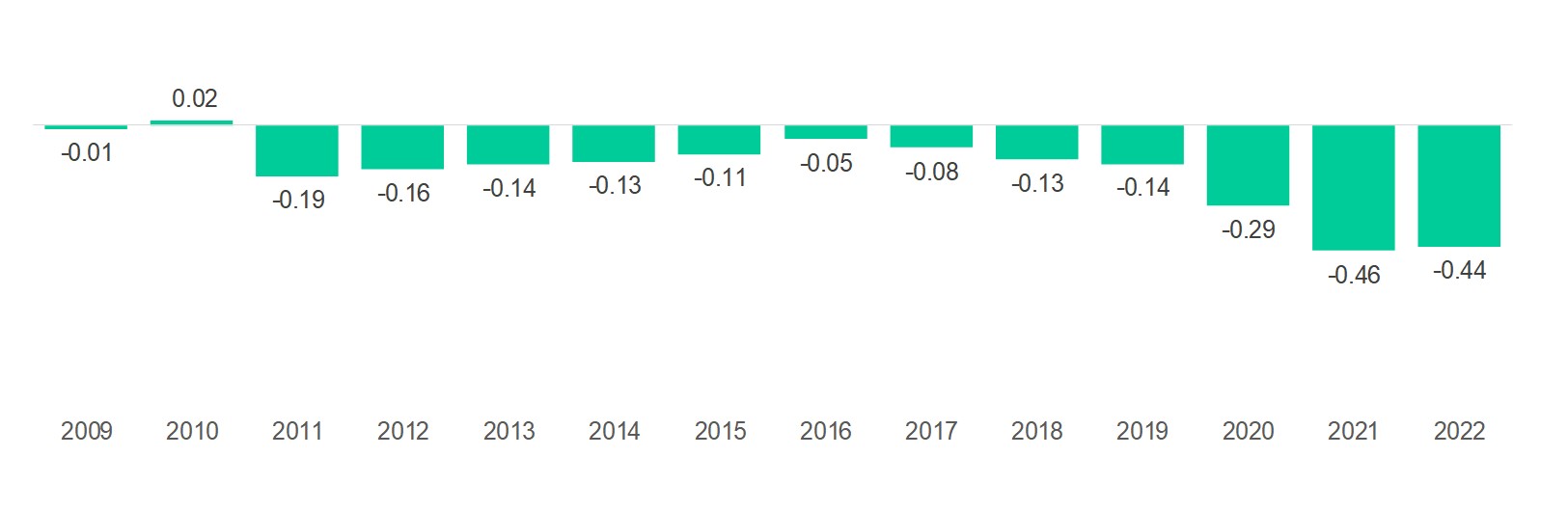

Population declines reducing growth

Japan has had the double edged challenge of a shrinking customer base with population growth in decline since 2010[1] and stagnant prices.. This leaves three approaches to drive top line growth and margin improvement: Pack size architecture, Innovation and Pricing and promotions.

Population Growth vs. Prior Year

Source: Population Growth, World Bank

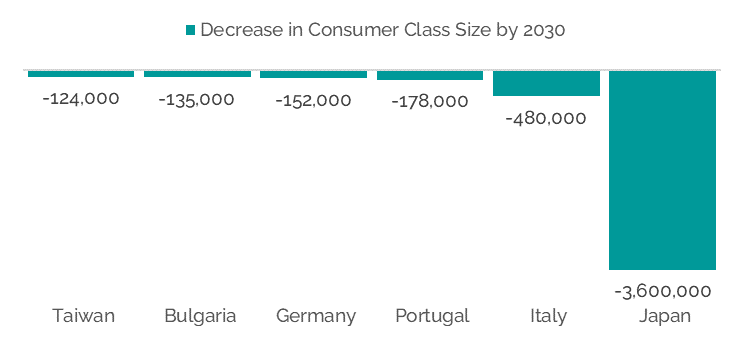

More concerning is that the number of people in the consumer class is reducing in Japan[2][3], so volume growth will need to be driven by individual consumption increases and price inflation.

Source: World Data Lab, World Data Pro

Focus on building the skills

To approach these three options businesses will need to have the relevant skills and business capabilities in place. Specifically, the function of Revenue Management needs to be evaluated on both whether the resources are in place and that they have the capabilities (tools, skills, experience) to take on this task. In post COVID Europe, the disruption of a blocked Suez, Ukraine conflict, low crop yields and inflationary labour markets meant price increases were moved from “pull cord in emergency” to regular occurrences. There was an increased comfort with taking increases, and inevitability that retailers would accept them, and that the end customer would not change their buying habits significantly to offset any benefits gained. The revenue management function became a critical part of the organisation, providing confidence in the impact on consumers, and providing clear guidance on price pack architecture to soften any significant disruption.

There are limitations on how much can be shared from European and US counterparts experience. Japan’s pricing and promotional approach differs significantly versus those in Europe the US, with the consumers conditioned to accept lower levels of discounting and having a greater resistance to price increases. This means that importing those critical functional skills with little market understanding or experience will place a greater risk of damaging overall performance.

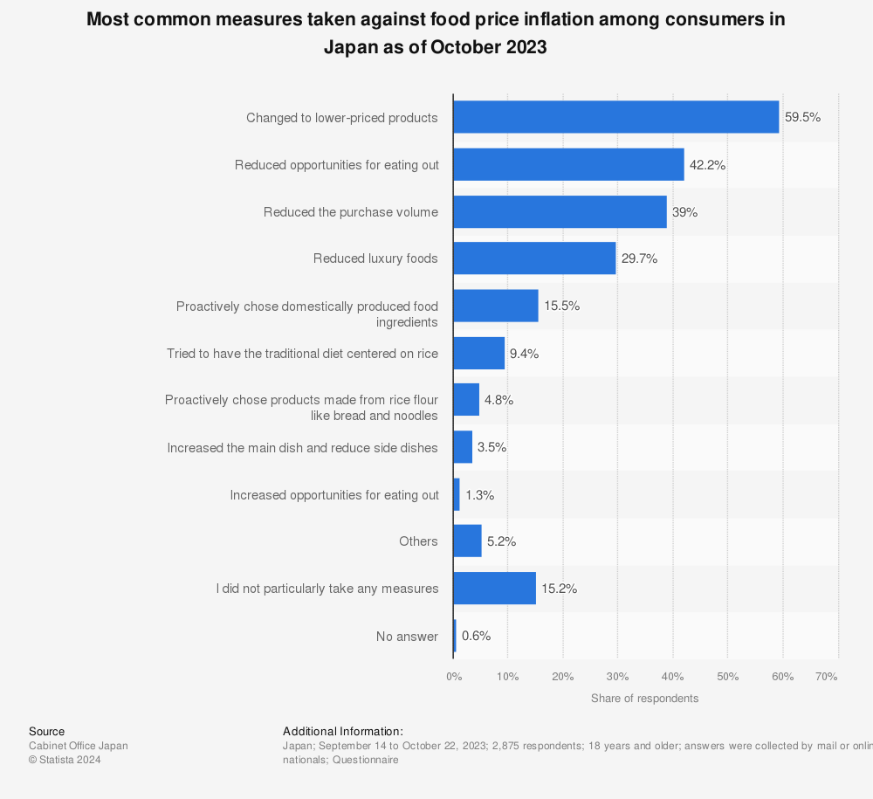

Japanese consumers are clear they will take corrective action to deal with the squeeze on their disposable income with trading down the most popular strategy, so there is little scope for a misstep in managing price changes.

Importance of price in driving margin

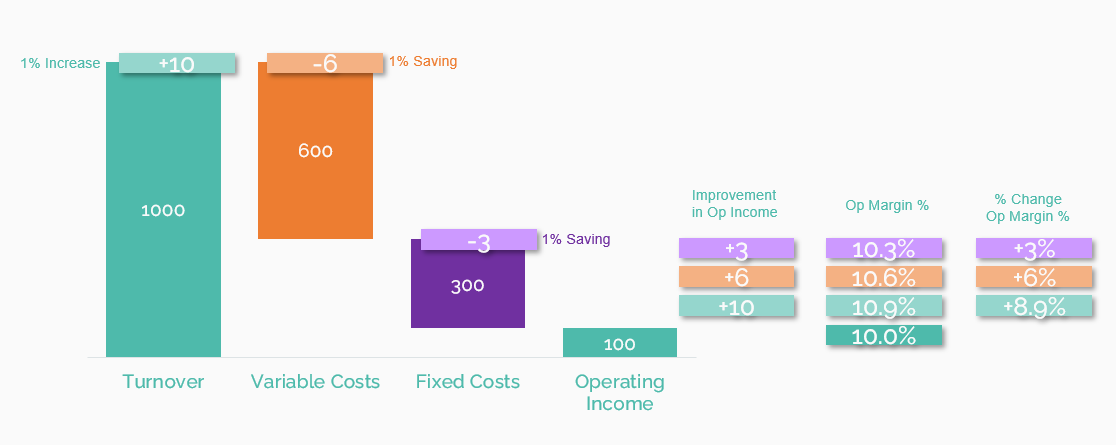

The McKinsey & Co study by Marn & Rosiello[4] demonstrated the power of 1% improvement in price when applied to different leavers in a business as compared to other areas businesses focus on to improve margin. With a price rise of just +1%, volumes remaining stable, an 8.9 percent increase in operating profits would be generated. That is +50% greater impact vs. a -1% saving in variable and even more vs an equivalent saving in fixed costs.

Knowing this underutilised power, why aren’t more businesses investing in pricing as a key powerhouse driving their strategic direction? Generally, because it’s not easy to deliver this increase through distributors, franchised retail and onto the end customer without some risk of business disruption or the risk that the volume impact is greater than expected.

Changing circumstances – implementing

Japanese retailers will most likely be prepping their buying teams for the expected negotiations on price which will start to appear. Price increase conversations for buyers are akin to finding a winning lottery ticket. Historical margins, space, promotional feature, and annual joint business plans can all be torn up and redrawn, in a more favourable way for the retailer and their customer who they are negotiating on behalf of. You have the additional challenge of little or no experience of senior leadership of any price increases, and in a business culture where deference to senior leadership is expected, there should be an expected inertia that slows down progress.

Retailers will now reconsider what their role is in the value chain. After years of praying for inflation to help deliver growth, throttling inflation to be the shoppers’ champion may become an even greater focus. It is the retailer who suffers the negative fall-out from price increases, with shoppers losing trust in the retailer and their value propositions very quickly when prices rise faster than the market. You only need to look at Asda’s (UK) market share decline (17.2% in 2011 to 12.8% in June 2024)[5] in the last decade as the German discounters redefined value in the UK and the previous leader on value, Asda, was unable to respond effectively.

Japanese retailers face additional headwinds. Markets such as the US, Europe and Australia have also been exporters and importers of talent where buyers and trading directors in major retailers and suppliers could easily transfer from experienced markets, bringing significant experience with them. As mentioned before, Japan’s language and cultural differences will potentially act as a barrier to prevent retailers benefiting from the best approaches when agreeing to price increases.

What good looks like – cultural differences

Japanese negotiation style is also far more collaborative, and relationship based. There should be an expectation that a share of the benefit from a price increase could be left on the table vs how increases are delivered in the West. This negotiation style can make it more difficult for western hired guns to make grand entrances, expecting to implement changes quickly.

Finally, the importance of hierarchy and respect in the Japanese culture can mean that despite the benefit of data justifying a change, there will be the potential that experience in the room could make a decision based on information other than what is presented.

These differences are not new to businesses operating in Japan for many years, however the inflationary environment will put some new pressures on finding the best way to operate. Japanese retailers will need to be helped through this period by their suppliers using customer first & retailer focused proposals to avoid the periods of conflict and disruption that other markets experienced in the 2010s. A key part of this will clearly be an open channel for top to top discussions.

What to consider when preparing for inflation

Here are some key principles we believe can best empower brands and own label suppliers to harness price to improve their businesses and deliver improved value for their retail partners and end customers.

Build your pricing capabilities (Develop your own or hire in the talent)

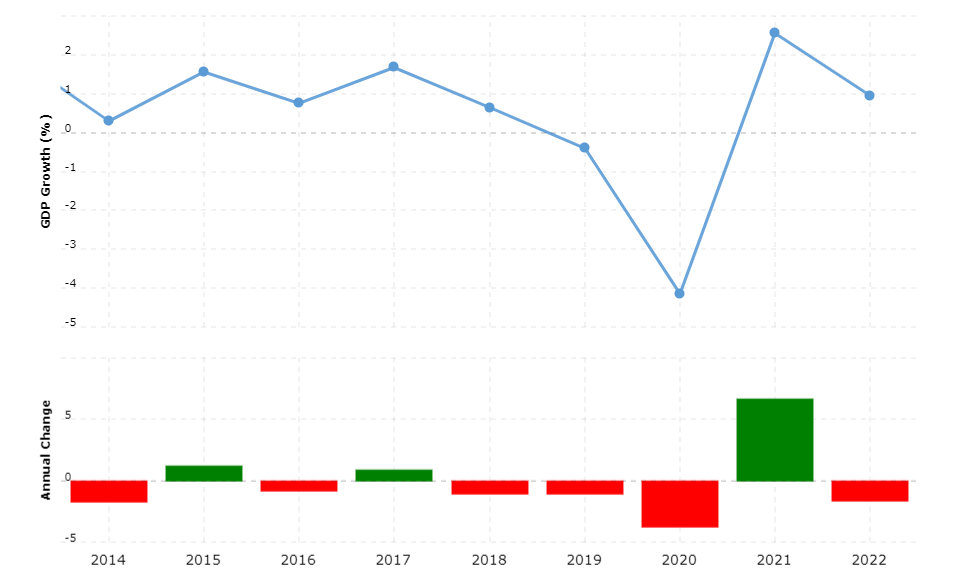

There is no value in repeating mistakes made by others. Build the capabilities needed to manage price pack architecture quickly so that pricing decisions can be made effectively and efficiently as inflation starts to become commonplace. Remember, every month of the year where a 10% price change is delayed will cost 0.8% of annualised growth which in a country where 5 out of the last 10 years saw growth of less than 1% in GDP per capita, will be very unpaletable for any shareholder or investor.

Japan GDP per capita growth % vs prior year

Data Source: Macrotrends, World Bank.

Accelerate customer knowledge now

Understanding the customer is difficult at the best of times and relying on sporadic data research or single source (e.g. EPOS data) will mean pricing decisions will feel inherently risky and ill informed. Set in place annual or bi-annual customer voice / customer willingness to pay studies to be able to track when there is an opportunity to take price. This information will prove vital when in discussion with your retail partner about the need for a change in price pack architectures.

Annual increase cadence

Begin the practice of annual increases, in the same way alcohol increases are made in UK and the annual spring “Shunto” negotiation for wage increases between unions and employees. Japan is already in the process of systemising increases in alcohol, aligning their duty rates by type of product and ABV, which will enable drinks businesses to take price more regularly. Annual increases have the benefit of small increases that do not disrupt consumer confidence or volume while enabling businesses to continue to invest in innovation, promotions and product improvements. The alternative of irregular increases, usually initiated when cost pressures cannot be held back any longer, results in more “till shock” and as is clear already, significant negative news.

Channel specific inflation

Tailor your pricing changes by channel as the need state, willingness to pay and ability to pass on the price will differ depending on the route to market and the occasion the channel services. As an example, Japan has the most advanced vending machine market which allows price changes to be updated centrally and could even enable fully dynamic pricing. The convenience store channel, which is mainly Franchise owned, will also require its own unique inflation. Deploying price pack architecture by channel will ensure that formats and prices match the usage needs of the customers and occasion.

Consumer lead innovation can support inflation

The innovation pipeline needs to be insight driven and product driven, with a real understanding of consumer unmet needs. Japan is already known for high velocity innovation pipelines driven by Japanese consumers & retailers high demand for novelty – however much of this novelty is changes in packaging and so not driving incremental growth. Customers willingness to pay for true innovation will justify the opportunity to take price. For identifying need state opportunities, be careful not to use the singular lens of geographic or demographic segmentation. These customers may look alike but their needs can differ greatly.

Segmenting the customer on their unmet needs will uncover innovation that delivers unique value to the customer and can justify a unique price point.

Do not rely wholly on premium innovation

Margin pressures are the general focus when innovation is planned, with innovation tasked with higher cash and % margin vs. current portfolio. The result is usually premium innovation. However, failing to innovate at the value end of the market risks ignoring a lower class which if it was a country would be the 14th biggest country in the EU by population. New competitors will happily spring up to focus on this group.

The stalling GDP per capita also means the Japanese middle class (which would be Europe’s biggest country by population), is not gaining purchasing power to continue to climb the pricing and premiumisation ladder. Own Label jumped on a similar opportunity in Europe, with a powerful momentum still building in the value tier, and in new venture brands.

Be open about Shrinkflation

South Korea has already highlighted the risk of shrinkflation and put legislation in place by the Korean Fair-Trade Commission (FTC)[6]. The equivalent in Japan (JFTC) does not have the same scope of role but there is a risk that if inflation does start to cause issues for the consumer that best practice could be shared between these organisations. Being upfront about pack size and pricing changes, highlighting they are consumer lead (e.g. maintaining a price point that more consumers can reach, or a pack size which reduces wastage, or family value to enable more families get better value) will ensure that clickbait headlines will not gain traction.

Partner with retailers to better meet the needs of the customer

Engage with the retailers to ensure they understand why price is a good thing for the category. This will be a part of a clear Category Strategy with growth drivers that include price as a lever to pull. Ensure you are thinking about retailer margin when constructing go to market plans on price pack architecture especially as optimising for your own margin will prevent a true partnership from being developed.

Conclusion

Navigating inflation in Japan's CPG and OTC markets requires a multifaceted approach. By building pricing capabilities, accelerating customer knowledge, implementing regular price increases, tailoring channel-specific strategies, driving consumer-led innovation, balancing premium and value products, addressing shrinkflation transparently, and partnering with retailers, businesses can turn inflation into an opportunity for growth. Drawing on global experiences and adapting them to Japan's unique context will be key to success in this new era of opportunity.

Key Principles for Empowering Brands and Suppliers

Develop Pricing Capabilities: Build in-house expertise or hire experienced talent to manage price pack architecture and strategic pricing.

Accelerate Customer Knowledge: Implement regular customer voice and willingness-to-pay studies to align pricing strategies with consumer expectations.

Establish Annual Price Increase Cadence: Adopt a practice of small, regular price increases to maintain consumer confidence and enable continuous investment in innovation.

Tailor Channel-Specific Inflation Strategies: Customize pricing strategies for different channels, considering the specific needs and price thresholds of each market segment.

Drive Consumer-Led Innovation: Use consumer insights to guide innovation, focusing on unmet needs rather than just demographics.

Balance Premium and Value Innovation: Innovate across the price spectrum to avoid losing price-sensitive customers and ensure comprehensive market coverage.

Address Shrinkflation Transparently: Communicate pack size and pricing changes clearly, emphasizing consumer benefits to maintain trust.

Partner with Retailers: Engage with retailers to explain the rationale behind price increases, ensuring mutual benefits and strengthening partnerships.

By adhering to these principles, CPG and OTC brands in Japan can navigate the inflationary landscape effectively, leveraging it as an opportunity for sustainable growth and enhanced business performance.

[1] Population Growth, World Bank: https://data.worldbank.org/share/widget?indicators=SP.POP.GROW&locations=JP

[2] Reducing consumer classes - Mapped: Countries With a Shrinking Consumer Class by 2030 (visualcapitalist.com)

[3] Consumer Class reducing – World Data - How the world consumer class will grow from 4 billion to 5 billion people by 2031 | Brookings

[4] The power of pricing: https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-power-of-pricing

[5] Retailer Market Shares, Kantar World Panel https://www.kantarworldpanel.com/ie/grocery-market-share/great-britain/range/06.02.11/09.06.24

[6] Shrinkflation ruling: https://www.koreatimes.co.kr/economy/20240503/korea-to-require-shrinkflation-signs-on-downsized-products