Are Consumers Actually Willing to Pay for Social Media? What Snapchat’s Backlash Really Tells Us

Background

As outlined in a recent BBC article, Snapchat’s decision to charge users for storage beyond 5GB has been met with significant backlash, underscoring how strongly people react when core platform features shift from free to paid. This reaction prompted us to examine a broader question: are users, in general, willing to pay for social media subscriptions at all, and how do emerging issues shape that willingness? Alongside storage fees, two other topics have gained momentum- concerns about platforms using public content to train AI systems and a growing frustration with both the volume and nature of adverts.

To understand how these factors influence consumer choice, we conducted a conjoint study assessing how users weigh trade-offs across storage capacity, AI-training permissions, advert experience, and platform choice and how the inclusion of different variants of these features impacts willingness to pay. Because Snapchat’s storage policy change motivated this research, we analysed these results primarily through the lens of Snapchat and its users.

Methodology

What Is Conjoint Analysis and How Did We Use It?

Conjoint analysis is a research method that helps reveal how consumers make decisions when products or services vary across multiple features. Instead of asking people directly what matters most, it places them in realistic choice scenarios where they must select between competing options. By analysing these choices, we can quantify which attributes drive preference and how much people are willing to pay for specific “upgrades”.

In this study, respondents evaluated hypothetical social media subscription plans that varied across five key attributes:

- Platform (e.g., Instagram, TikTok, Snapchat, X, Facebook, Reddit)

• Storage capacity (various options from 5GB-500GB)

• Use of public content for AI training (allowed vs. not allowed)

• Ad experience (no ads, reduced ads- personalized or non-personalized, standard ads- personalized or non-personalized)

• Monthly price (different ranges were shown based on storage level presented. For example, subscriptions with 5GB storage as a feature had a range of $0.49-$1.35 while those with 500GB had a range of $1.49-$4.10).

Each respondent was given 10 choice tasks in which they were presented with three options and instructed to select which social media subscription package they were most likely to purchase or “none of these” if they would not purchase any.

Figure 1: Conjoint Choice Activity

Figure 1: Conjoint Choice Activity

(click to enlarge)

This structure allowed us to measure overall willingness to pay and understand how storage, AI-training permissions, and advert experience influence consumer preferences.

Sample

The survey was distributed to a sample of n=295 balanced across age, gender, income, and current technology subscription usage to ensure results representative of US social media users.

Output

From this controlled design, we were able to estimate willingness to pay for different features and simulate uptake (preference share) for different subscription configurations. By modelling alternative subscription bundles, we can identify which combinations drive the highest consumer interest and where platforms would face resistance.

Findings

Storage Capacity

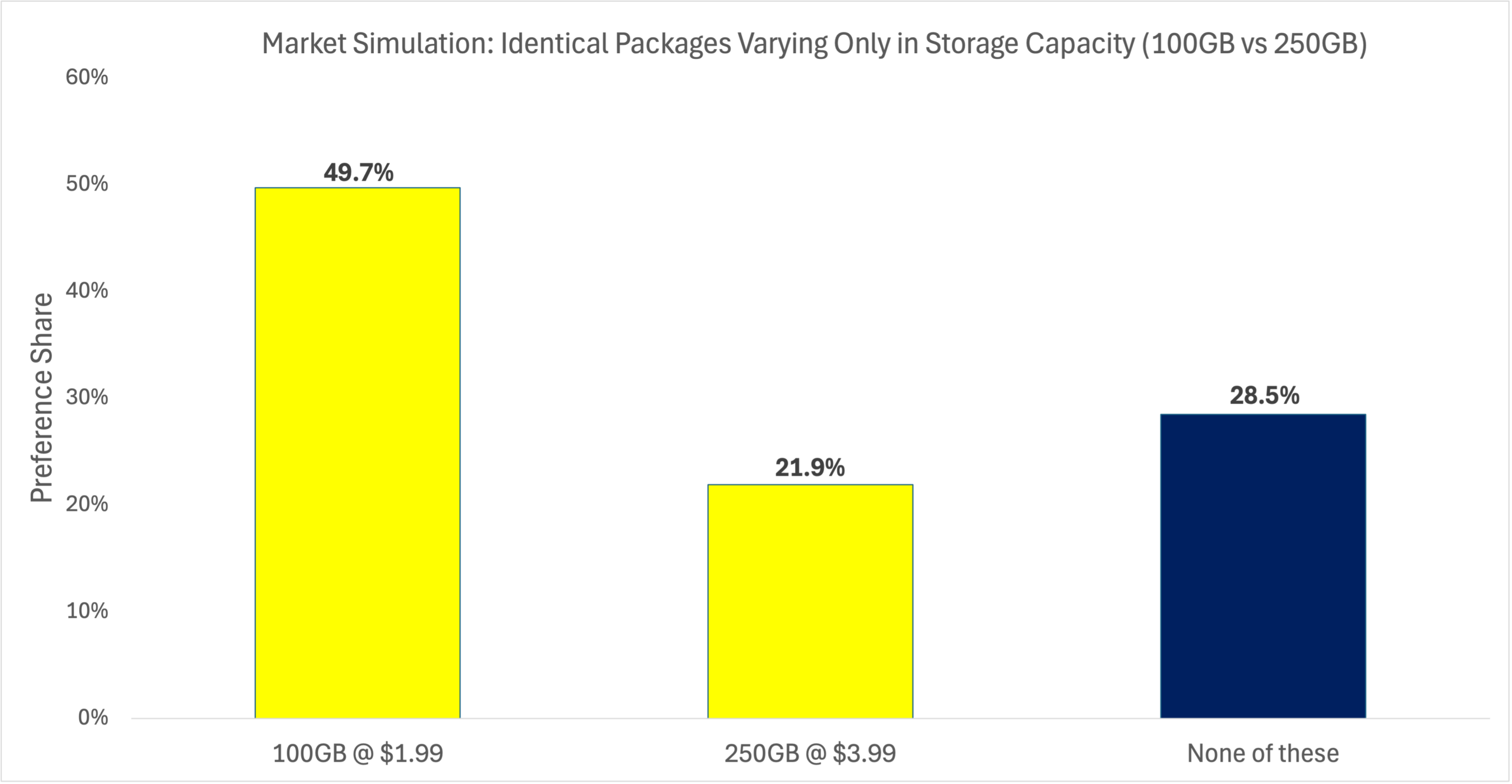

Returning to the question that prompted this research, our analysis shows promising news for Snapchat. Among current Snapchat users, when presented with the two subscription options currently offered, 100GB at $1.99 per month and 250GB at $3.99 per month, only 28.5% chose not to purchase either. Despite the public backlash around storage fees, this result indicates that when consumers must make an actual choice, the majority are willing to pay for upgraded storage.

Figure 2: 100GB vs 200GB Preference Share

Figure 2: 100GB vs 200GB Preference Share

(click to enlarge)

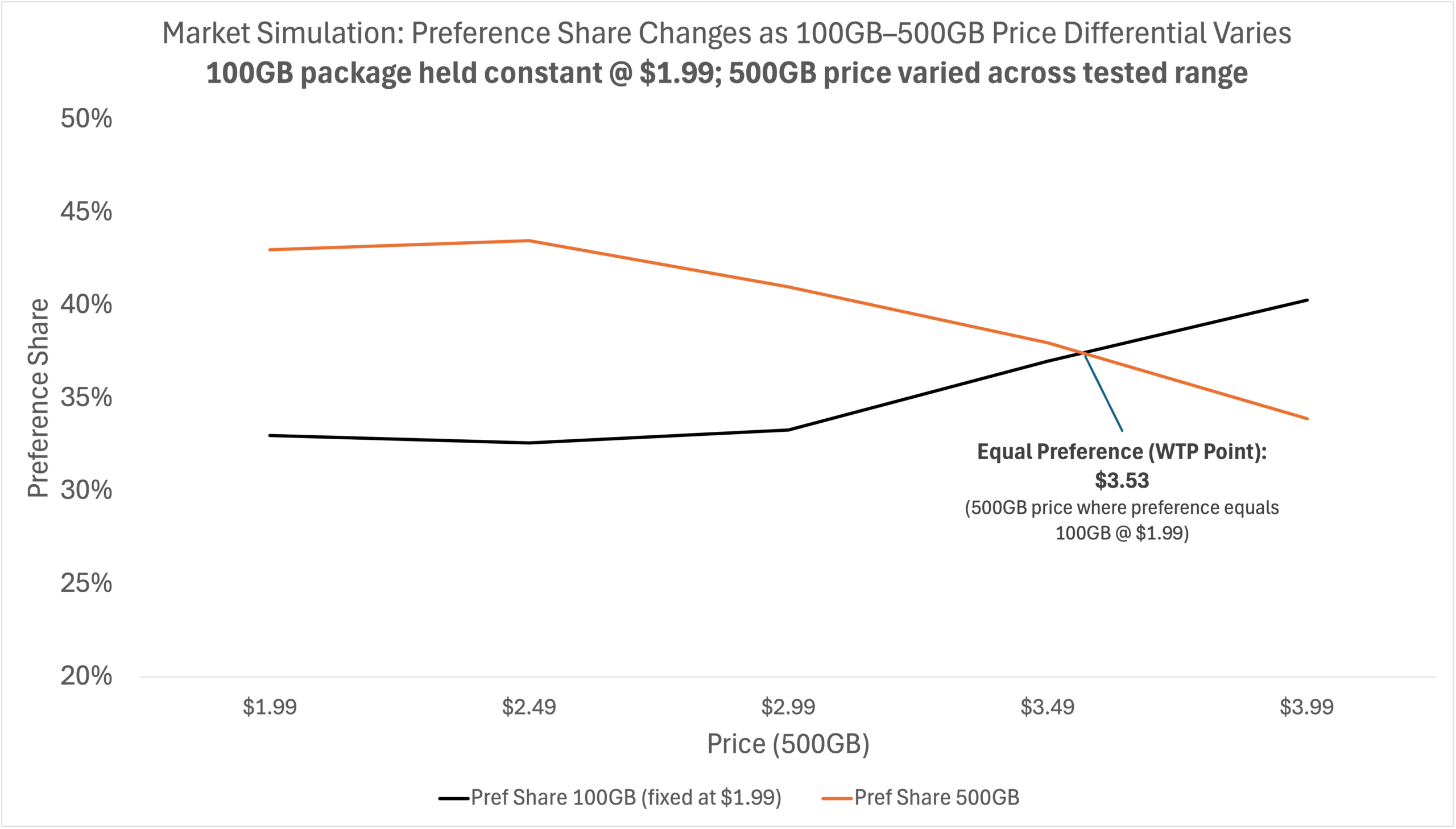

Conjoint also allows us to quantify that willingness. Comparing 100GB with the maximum tested 500GB, we find that at a $1.54 price difference ($1.99 vs $3.53), consumers place equal value on the two options. This type of WTP analysis helps platforms evaluate whether “trading up” between storage tiers meaningfully increases perceived value and where price increases may exceed consumer tolerance.

Figure 3: Preference Share Curves for 100GB and 500GB as the Price Differential Varies

Figure 3: Preference Share Curves for 100GB and 500GB as the Price Differential Varies

(click to enlarge)

Use of Public Content for AI Training

When examining AI training preferences among Snapchat users, we found that respondents actually preferred the option where their publicly available content would be used to train AI models. In a WTP analysis, we were able to quantify this increased preference as $0.30 more per month for a subscription with Public content training vs an identical one without.

This difference is small, however, relative to other attributes tested and therefore indicates that it is not a primary driver of subscription choice. Importantly, our survey emphasized that only publicly available content would be used for training. Future research should test whether preferences change when non-public data is involved, as attitudes toward AI training may shift significantly when different types of content are considered.

Ad Experience

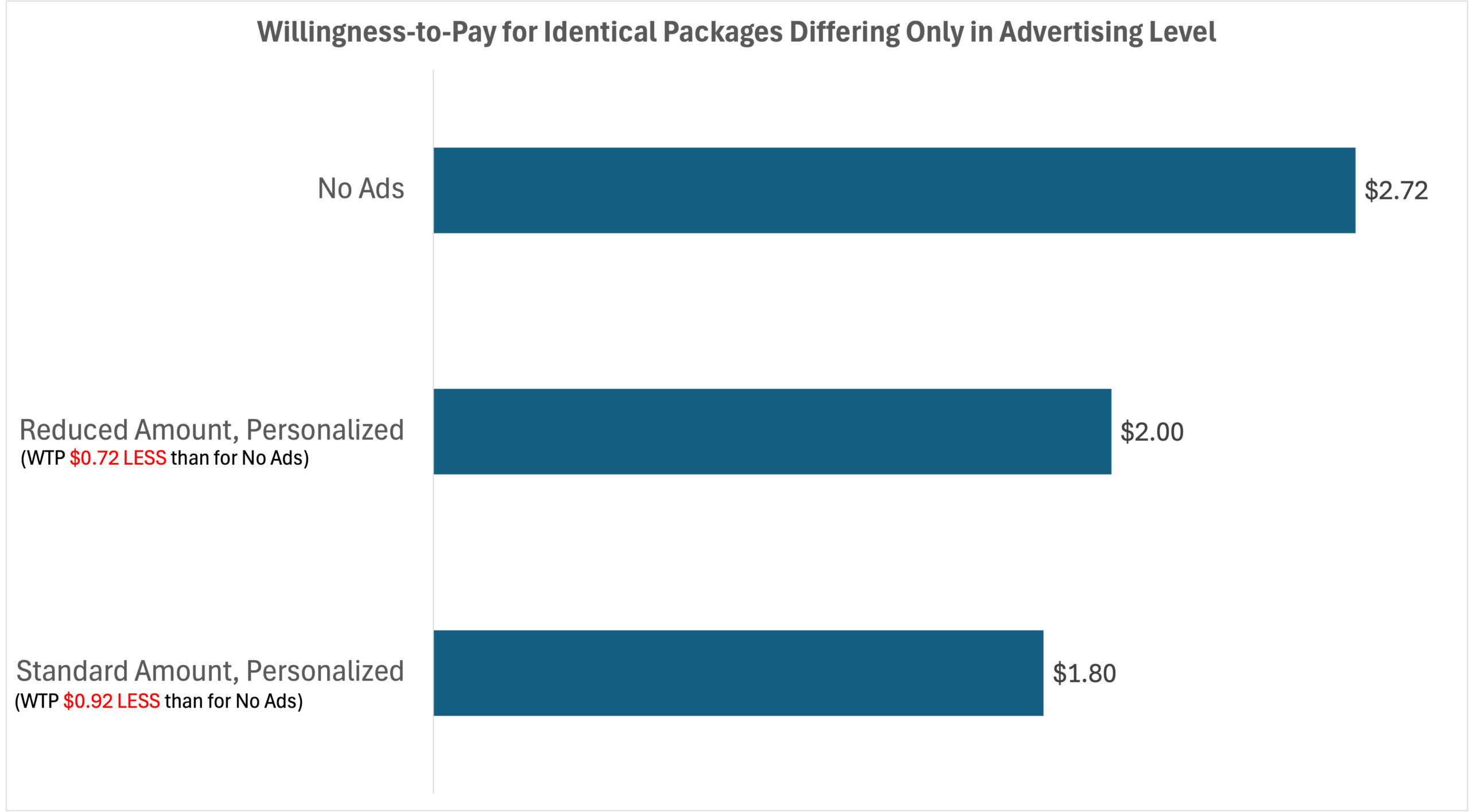

Advert experience produced clear differences in how users evaluated subscription options. In our simulation the package with no adverts attracted the highest preference share, with more than 33% of preference, when all other features were held constant. Options with reduced adverts, whether personalized or not, also outperformed standard advert loads, each drawing roughly 15 to 16% share, while the standard not personalized configuration received the lowest share- nearly 0%.

Willingness-to-pay results reinforce this pattern. Respondents were willing to pay an additional $0.72 to move from reduced personalized adverts to no adverts and $0.92 to move from standard personalized adverts to no adverts. The similarity between the WTP values indicates that users perceive standard adverts and reduced adverts as offering nearly the same level of value. In other words, both are viewed as similarly distant from a fully ad-free experience, which limits the distinctiveness of a reduced-ad tier.

Figure 4: Willingness-to-Pay Premium For No-Adverts Subscription

Figure 4: Willingness-to-Pay Premium For No-Adverts Subscription

(note: due to constraints in the price range tested, it was necessary to start at $1.80-slightly below the current advertised price for 100GB to find the price differential for which all three options are considered equally appealing)

(click to enlarge)

Competitive Landscape

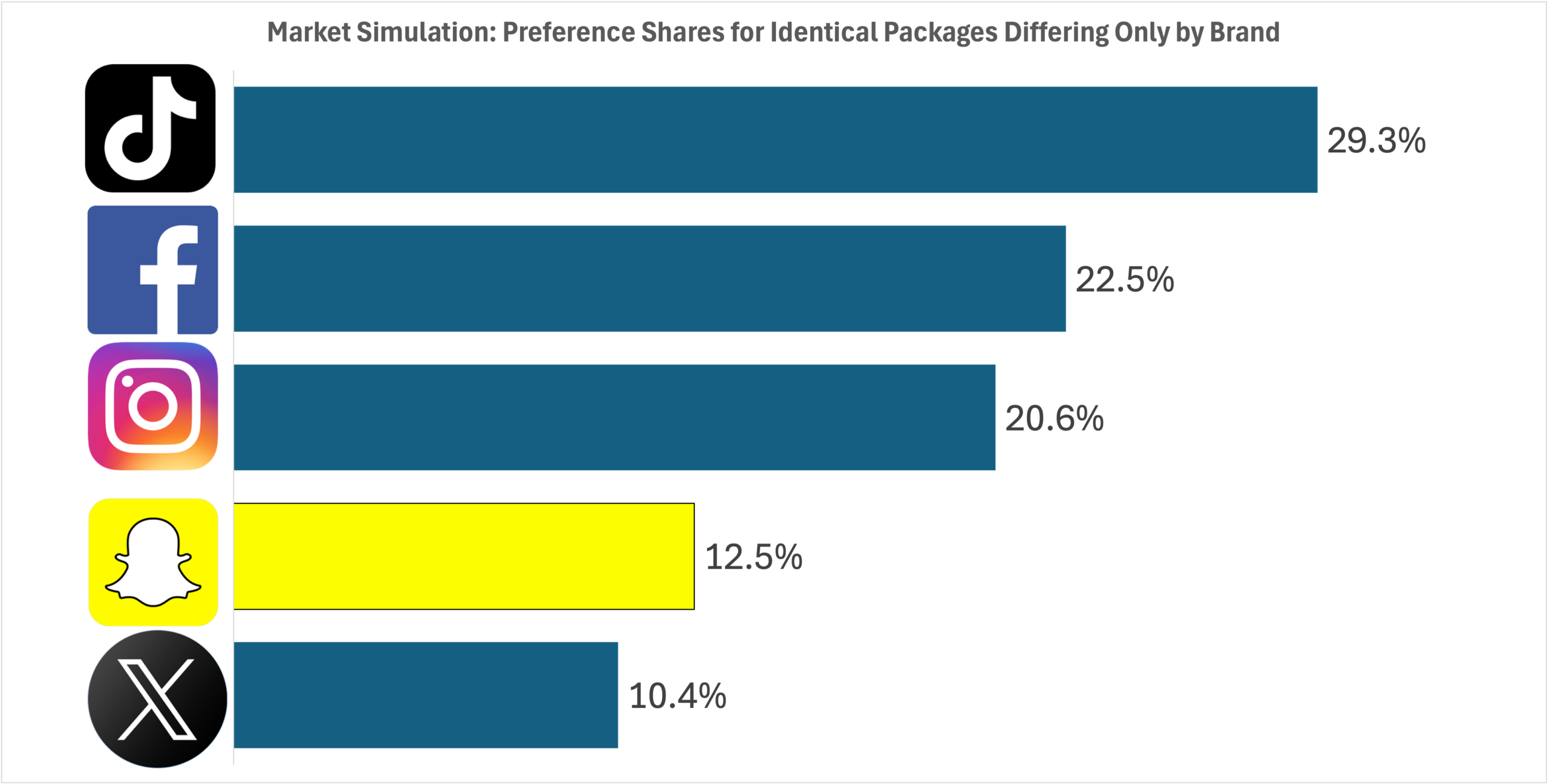

Finally, conjoint analysis enables us to examine not just the appeal of individual features, but how a subscription offer performs in a competitive market. To do this, we tested an identical subscription package across five platforms, Facebook, Instagram, TikTok, Snapchat, and X, so the only factor driving choice was platform brand. This analysis included only respondents who actively use all five platforms.

In this controlled scenario, Snapchat performed noticeably worse than its competitors. Around 12 percent of respondents selected Snapchat’s version of the subscription, compared with 20 to 29 percent for Facebook, Instagram, and TikTok.

Figure 5: Brand Influence on Preference for Identical Packages

Figure 5: Brand Influence on Preference for Identical Packages

(click to enlarge)

This suggests that Snapchat faces a brand-based disadvantage even before pricing or feature differentiation is considered. If subscription models become a broader industry norm, Snapchat may need to rely more heavily on unique features, targeted value propositions, or pricing incentives to compete effectively.

Conclusion

As the social media landscape shifts toward paid features and subscription models, understanding how consumers evaluate trade-offs has never been more important. This study demonstrates that stated consumer outrage does not always translate into actual behaviour, that sensitivity to features like storage, AI training, and advert experience varies widely, and that platform brand alone can significantly influence willingness to adopt a subscription.

Conjoint analysis proved critical in revealing these nuances. It allowed us to quantify willingness to pay, pinpoint which feature changes meaningfully shift consumer preference, and highlight where perceived value does not justify a higher price. Just as importantly, it enabled competitive simulations that quantified the influence of platform brand itself, showing how the same subscription can perform very differently depending on who offers it. For Snapchat, the findings indicate both opportunity, strong consumer WTP for higher storage and ad-free tiers, and challenge, as the platform currently faces a brand-based disadvantage relative to competitors

Get in touch with us today to explore how conjoint analysis can help you optimize everything from subscription models and pricing tiers to product bundles and competitive positioning. Conjoint turns complex consumer trade-offs into clear, actionable guidance. Let us help you use it to make confident decisions about your next product or pricing move.